stop quote vs trailing stop quote

A trader who wants to purchase or sell the stock as quickly as possible would place a market order which would in most cases be executed immediately at or near the stocks current price of 139 white line--provided that the market. Learn how to use a trailing stop loss order and the effect this strategy may have on your investing or trading strategy.

Limit Orders vs.

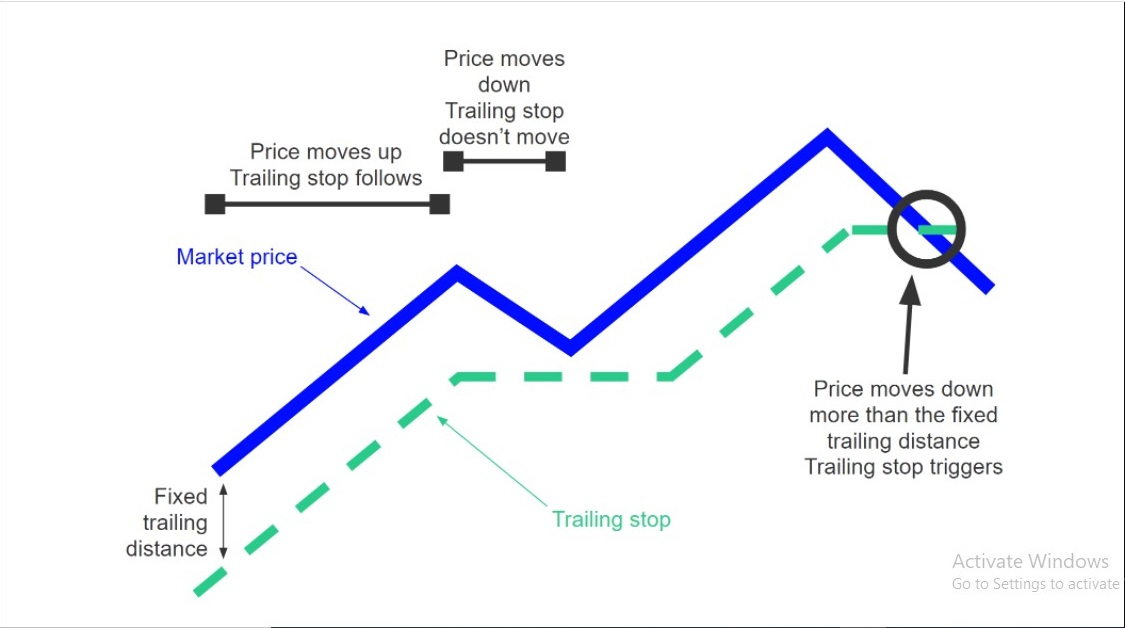

. Put simply a trailing stop order is a risk management technique where a trader sets their stop loss level to trail the current market price by a specified value or percentage. It places a limit on your loss so that you dont sell too low. Sell order for stop quote limit order is placed when the price is below the stocks current market price and it will trigger when the price is lower than the decided price.

Brokers add the term stop on quote to their order types. In this article well go over why Merrill Edge decided to rename their stop order and stop limit order to. Generally a Stop on Quote is called a stop loss or stop order a stop limit on quote is called a stop limit and a trailing stop is well.

To place a trailing stop with MetaTrader 4 or 5 simply right-click on the open position select Trailing Stop from the drop-down menu and select the number of pips to trail the price. For example say you have a stock trading at 10 and you put a stop loss at 9 and a stop limit at 850. In this example the last trade price was roughly 139.

When the stock price touches some level it triggers an order. A buy or sell stop quote on Merrill Edge will be executed once the market price hits the specified stop quote level. Even though he had 10000 invested.

Since a market order has no conditions as to what price it may be executed at it is typically filled immediately. Many brokers use 5-digit price quotes with the fifth decimal place called a pipette or point. An investor places a trailing stop for a long position below the.

Were risking VWAP at 6. A buy stop quote order is placed at a stop price above the current market price and will trigger if the national best offer quote is at or higher than the. We could also have put a trailing stop market order on it We enter the trade at the high of the day which is 650.

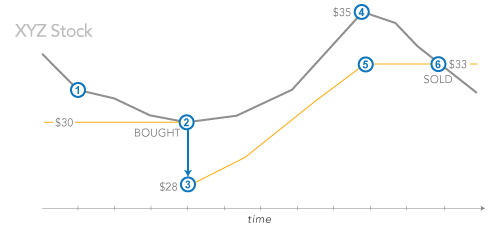

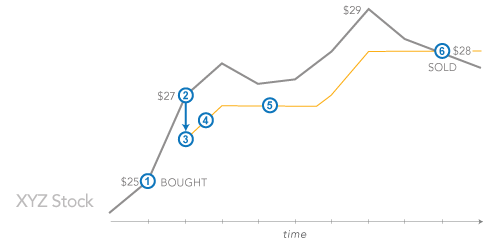

If you use a stop-limit order once the stop level is reached a limit order. From the examples above it may seem like a trailing stop limit is the obvious choice due to its greater flexibility however do. When your trailing stop limit order is triggered the execution order for the trade will be.

In a trailing stop limit order you specify a stop price and either a limit price or a limit offset. Trailing stop orders may have increased risks due to their reliance on trigger pricing. Stop quote vs trailing stop quote.

A stop-limit-on-quote order is a type of order that combines the features of a stop-on-quote order with those of a limit order. Stop Quote limit order is a combination of both a stop quote and a limit order. A Stop on Quote Order enables an investor to execute a trade at a specified price or better after the quoted stock price reaches the desired stop price.

Investing 101 Investing Strategies. You enter a stop price of 6170 and a limit offset of 010. Stop orders all do basically the same thing.

A trailing stop loss order adjusts the stop price at a fixed percent or number of points below or above the market price of a stock. Stop limit on quote vs stop on quote etrade. It is used by investors who want to limit their downside to ensure that a stock is sold before the price falls too far.

The point of stop-loss orders is to automatically close your position if some conditions is met a long position goes too low or a short. Our goal is 8. In our trailing stop order example we place a trailing stop limit order on Stock X.

Stop quote orders are the same as stop orders but have been renamed by Merrill Edge in 2013 due to a FINRA rule change. A trailing stop limit is an order you place with your broker. The stop order is an order type that immediately sends a market order when the market hits the set stop loss level.

A trailing stop-on-quote order is a trailing sell stop that fluctuates by a given percent or point dollar amount allowing for the potential to lock in more profit on the upside while. Say you own XYZ right now at 100share but youre afraid itll go down. This is a solid plan and it seems to be working.

If the calculated stop price is reached the order will be activated and become a market order. The above chart illustrates the use of market orders versus limit orders. In the picture above a trailing stop of 60 points would.

Stop on Quote vs. A trailing stop limit order can set a specify percentage or a dollar amount to exit the trade. Designed to initiate a sale or purchase when a securities price hits a certain point.

A trailing stop limit order allows you to set a specific trigger price this quantifies how much the price should move against the trade before an exit signal. A trailing stop is a stop order that can be set at a defined percentage away from a securitys current market price. Stop on quote orders can.

So you set. If the stock suddenly crashes to 7 making your sell order at 7 the.

Understanding A Trailing Stop Limit Order Cibc

Trading Faqs Order Types Fidelity

Trailing Stop Loss How Trailing Stop Loss Order Works Trailingcrypto

Trading Faqs Order Types Fidelity

Dynamic Trailing Stop Dts Fibozachi Trading Indicators

Stock Market In Trailing Stop Limit Orders What Does The Limit Offset Mean Economics Stack Exchange

Trailing Stop Buy Trailing Buy Order Trailingcrypto

Trailing Stop Sell Stop Loss Orders Trailingcrypto

Investor Bulletin Stop Stop Limit And Trailing Stop Orders Investor Gov

An Introductory Guide To Trailing Stop Trailing Stop Loss And Trailing Stop Sell Order In Cryptocurrency By Trailingcrypto Medium

Trading Up Close Stop And Stop Limit Orders Youtube

/dotdash_Final_How_the_Trailing_Stop_Stop_Loss_Combo_Can_Lead_to_Winning_Trades_Sep_2020-01-3e4697527ad041809b1528ed6d5e0fa2.jpg)

Trailing Stop Stop Loss Combo Leads To Winning Trades

Trailing Stop Sell Stop Loss Orders Trailingcrypto

4 Stop Order Techniques To Help Save Your Capital Tradesmart University

What Is A Trailing Stop Order Novel Investor

Options Trailing Stop Loss By Optiontradingpedia Com

Trailing Stop Loss Vs Trailing Stop Limit Which Should You Use