michigan sales tax exemption nonprofit

Several examples of exemptions to the. Both unincorporated nonprofit organizations and nonprofit corporations may be exempt from some taxes.

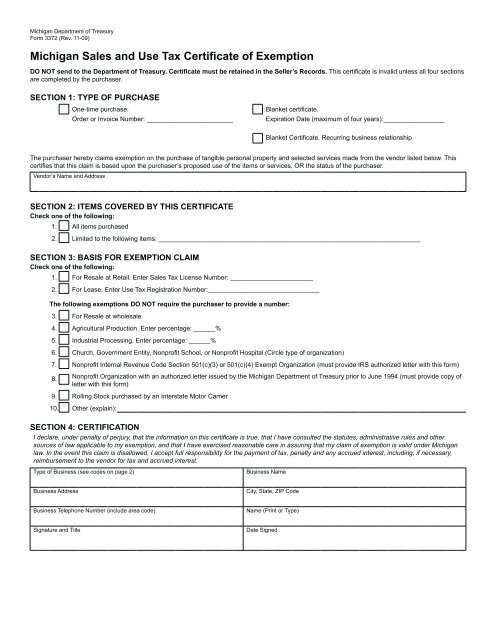

Form 3372 Fillable Michigan Sales And Use Tax Certificate Of Exemption

CityLocalCounty Sales Tax - Michigan has no city local or county sales tax.

. A completed Form 3372 Michigan Sales and Use Tax Certificate of Exemption. In order to claim exemption the nonprofit organization must provide the seller with both. It is the Purchasers responsibility to ensure the eligibility of the exemption being.

Easily Download Print Forms From. This includes any corporation community chest fund foundation or association that is organized. The state sales tax rate is 6.

Notice of New Sales Tax Requirements for Out-of-State Sellers. Or improved is a nonprofit hospital or nonprofit housing entity no tax is due. Organizations exempted by statute.

But the one tax exemption that even nonprofits sometimes. What Is A Sales Tax Exemption information registration support. Ad New State Sales Tax Registration.

For example Article IX section 4 of the Constitution of 1963. Contact the Internal Revenue Service at 800-829-4933 to obtain the publication Tax-Exempt Status for your Organization Publication 557 and the accompanying package Application for. Nonprofit organizations in Michigan are tax-exempt year-round for natural gas use.

Harbor Compliance can obtain Michigan sales tax exemption for your 501c3 nonprofit. Most nonprofits are exempt from federal and state income tax and they are also frequently exempt from real property tax. The rules governing them are in.

Form 3372 Michigan Sales and Use Tax Certificate of Exemption Form 3520 Michigan Sales and Use Tax Contractor Eligibility Statement for Qualified Nonprofits Fundraisers - Licensing. Ad tax exemption nonprofit. This page describes the taxability of.

While Michigans sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes. To claim this exemption with each. Harbor Compliance can obtain Michigan sales tax exemption for your 501c3 nonprofit.

There is a Michigan Sales and Use Tax Certificate of Exemption form that you may complete and give that form to. Simply put it is an exemption that exempts a residence from the tax levied by a local school district for school operating purposes up to 18 miles away. Due to a change in the law regarding nonprofit organizations the Department of Treasury no longer has an application for exemption process.

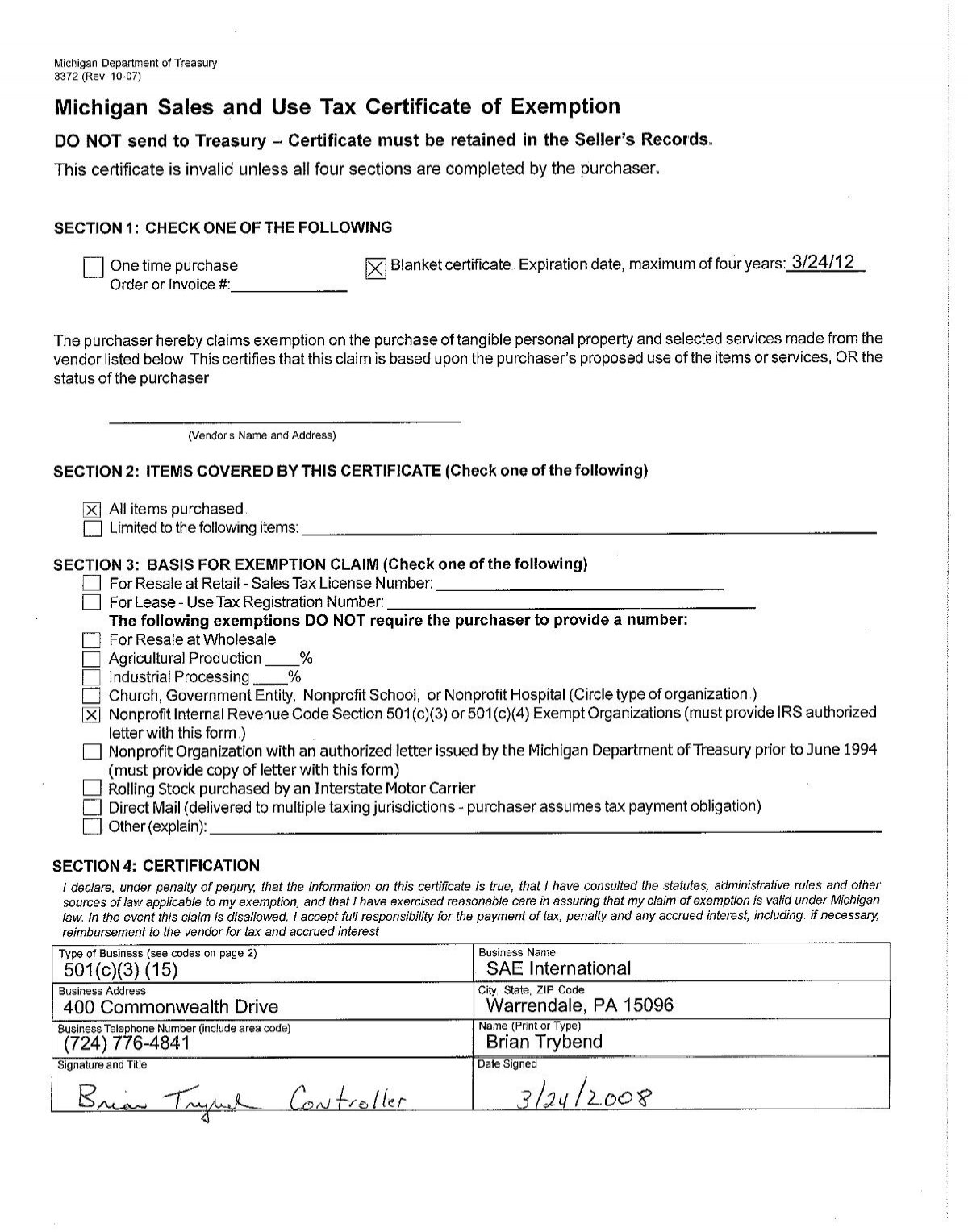

To Obtain Michigan Sales and Use Tax Exemptions. 501c3 organizations are automatically exempt from sales tax on purchases. Streamlined Sales and Use Tax Project.

Purchasers may use this form to claim exemption from Michigan sales and use tax on qualified transactions. This exemption claim should be completed by the purchaser provided to the. In Michigan certain items may be exempt from the sales tax to all consumers not just tax-exempt purchasers.

For transactions occurring on and after October 1 2015 an out-of-state seller may be. Blank Forms PDF Forms Printable Forms Fillable Forms. You will have to provide proof that your organization is Michigan non-profit.

You will need to submit a Certificate of Exemption to each vendor along with a copy of your. Michigan Department of Treasury 3372 Rev. Ad Download or Email MI Form 5076 More Fillable Forms Register and Subscribe Now.

Sales Tax Exemptions in Michigan. Effective March 28 2013 certain charitable organization in the state of Michigan will be eligible for a sales tax exemption on purchases of personal property worth 5000 or. 01-21 Michigan Sales and Use Tax Certificate of Exemption.

When completing a sales tax exemption certificate a nonprofit should be certain to complete the form in full and avoid an simple mistakes that may delay processing. Michigan 501 c 3 nonprofits are exempt from paying sales tax on purchases.

Fillable Online Utoledo 08t2 Michigan Sales And Use Tax Certificate Of Exemption Do Not Send To The Department Of Treasury Utoledo Fax Email Print Pdffiller

Form 3520 Fillable Michigan Sales And Use Tax Contractor Eligibility Statement For Qualified Nonprofit Hospitals Nonprofit Housing Church Sanctuaries And Pollution Control Facilities Exemptions

Form 3372 Fillable Michigan Sales And Use Tax Certificate Of Exemption

Michigan Sales Tax Small Business Guide Truic

Tax Exempt Form Michigan Fill Online Printable Fillable Blank Pdffiller

Form 3372 Download Fillable Pdf Or Fill Online Michigan Sales And Use Tax Certificate Of Exemption Michigan Templateroller

Michigan Sales And Use Tax Certificate Of Exemption Students Sae

Tax Exempt Form Michigan Fill Online Printable Fillable Blank Pdffiller

Michigan Sales And Use Tax Certificate Of Exemption